China outward direct investment break new ground in destinations and sectors

China outward direct investment break new ground in destinations and sectors, countries, and regions such as Czech Republic, the Nordics, Spain, Poland, Türkiye, besides Japan, South Korea, Singapore, Indonesia Thailand, India, Brazil, and Africa, etc.,

China outward direct investment break new ground in destinations and sectors, countries, and regions such as Czech Republic, the Nordics, Spain, Poland, Türkiye, besides Japan, South Korea, Singapore, Indonesia Thailand, India, Brazil, and Africa, etc.,

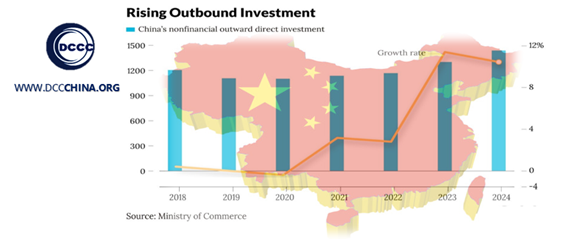

Advanced manufacturing and mobility, the electric vehicle supply chain, energy and resources, and infrastructure are the most desirable sectors for China outward direct investment that continue break new ground in destinations and sectors in 2025.

As 2025 marks the final year of the 14th Five-Year Plan, despite facing multiple obstacles and external complexities, Chinese enterprises keep on with high spirits, leveraging their strengths to thrive in the global market.

The trend of Chinese enterprises expanding abroad, keep on breaking new ground in both destinations and sectors, driven by brand and the advanced technology. Typical example happened recently according to a related report...

The trend of Chinese enterprises expanding abroad remains robust, driven primarily by brand and technology. Main investment sectors included advanced manufacturing and mobility, the electric vehicle supply chain, energy and resources, and infrastructure. The Czech Republic stands as one of China’s key economic partners in Central and Eastern Europe.

The trend of Chinese enterprises expanding abroad remains robust, driven primarily by brand and technology. Main investment sectors included advanced manufacturing and mobility, the electric vehicle supply chain, energy and resources, and infrastructure. The Czech Republic stands as one of China’s key economic partners in Central and Eastern Europe.

Chinese investments in Europe, particularly, the Czech Republic market are characterized by several key trends. Greenfield investments have steadily increased as Chinese firms seek to establish new operations.

Additionally, the financial industry has emerged as a new hotspot for Chinese capital, and traditional sectors, particularly manufacturing, are witnessing a revitalization.

Currently, more than 50 Chinese enterprises operate in the Czech Republic, spanning a wide array of industries such as manufacturing, information technology, transportation and warehousing, finance, and real estate and entertainment.

In manufacturing, leading companies such as Sichuan Changhong Electric, Qingdao Hisense Europe Holding, and Zhejiang Chint Electric have made significant inroads, particularly in electrical equipment and automotive sectors.

Firms like Yapu Automotive Components, Ningbo Jifeng Automotive Parts, and Beijing Jingxi Heavy Industry underscore the importance of automotive manufacturing, while other enterprises in areas like machinery and plastics further diversify the industrial base.

In the information and communication technology sector, companies like Huawei, ZTE, and TP-LINK have established a strong presence. Over the next five years, Huawei plans to invest around US$360 million, with the potential to create approximately 4,000 new jobs.

The financial sector has also attracted notable Chinese investment. Huaxin Group, for example, has made significant acquisitions, including a 50 percent stake in the Czech J&T Financial Group, marking it as the first Chinese private enterprise to control a European bank.

In the aviation sector, Zhejiang-based Wan Feng Auto Holding Group has taken a substantial step by signing a strategic cooperation agreement with a Czech firm to establish an aircraft R&D center.

Beyond these prominent sectors, Chinese companies are expanding into general aviation, wholesale and retail, research, and other fields. These diverse investments provide Chinese firms with a robust platform for expanding their international presence in a dynamic European market.... See more from original report here

In conclusion, As mentioned above, 2025 marks the final year of the 14th Five-Year Plan, for outbound enterprises, 2025 will be a year of significant challenges, Looking forward to 2025, more Chinese enterprises to navigate overseas effectively and steadily, leveraging their strengths to thrive in the global market.

In conclusion, As mentioned above, 2025 marks the final year of the 14th Five-Year Plan, for outbound enterprises, 2025 will be a year of significant challenges, Looking forward to 2025, more Chinese enterprises to navigate overseas effectively and steadily, leveraging their strengths to thrive in the global market.